A 2020 survey from GlobalData looking at the primary reasons for customers to choose one remittance provider over another highlighted that the most important factor, by far, is the offer of a quick and easy payments experience.

This demonstrates an important point: that the priority which users place on the experience versus the transaction cost has now extended beyond high value and domestic payment services to lower-value cross-border payment services.

Digital remittances therefore present two major opportunities for the financial industry: firstly, of course, is the chance to reduce the cost of sending remittances to support sustainable development; but increasingly important to users is the need to improve the customer experience by making it as easy to send a remittance payment as to send a text message.

Failure to do so by payment service providers means the difference between retaining customers or losing them to a better offer.

The state of play in remittances

Already being transformed by digitalisation, changes to the cash, bricks and mortar-dominated space of worker remittances have been intensified by the global pandemic. In his book, “The power of micro money transfers”, Arunjay Katam showed that Covid-19 brought forward almost half a decade of digitalisation in two months.

Remittance volumes are also rising as the world comes out of lockdown. Officially recorded remittance flows to low- and middle-income countries (LMICs) are expected to increase by 4.2% this year to reach US$630 billion, according to the World Bank’s latest Migration and Development Brief, released in May 2022.

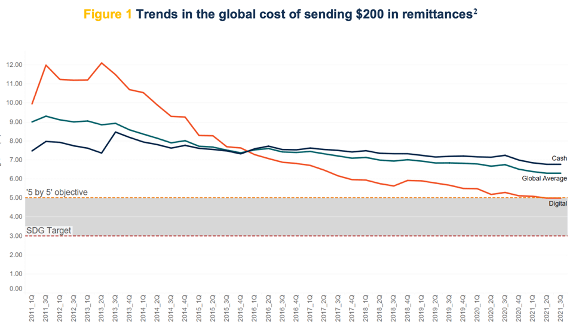

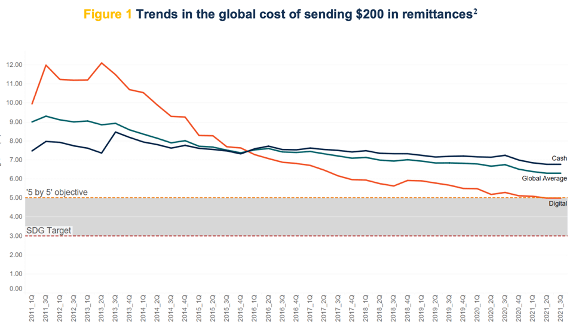

World Bank figures show that fees account for a large portion of the costs for remittance services. They also differentiate between digital and non-digital remittances and reveal costs for non-digital services are consistently higher than those for digital services, regardless of the region where the money is being sent.

Source: World Bank, Remittance Prices, September 2021

Research from the payments industry supports World Bank statistics. A report from PayPal and Xoom says that the average cost of sending a digital remittance is just 3.93%, almost half the cost of traditional remittances.

Cost matters. According to the World Bank, lowering remittance fees by 2 percentage points would potentially translate to US$12 billion of annual savings for international migrants from LMICs.

This makes it critical to speed-up the move from cash-based to digital remittances – and to make it easy to do so.

Smoothing the flow

There are three critical steps in the journey of a digital remittance: the quotation; capturing beneficiary details; and monitoring the payment. Each one represents a potential pain point in the process, so smoothing their operation helps to cut the cost of service delivery as well as enhance the user experience.

Banks and fintechs have already taken steps to improve the quotation and monitoring elements of the process. Services such as SWIFTgpi, for example, mean that customers will know the exact cost and speed of their payment – and payment services will be increasingly competitive based on that information.

However, capturing the beneficiary details is still a painful step for many providers and their users. Customers who want to make an international payment – whether high or low value – must spend too long creating the payment instruction and tracking down complicated payee details; this can make the overall experience complex and daunting.

It does not need to be that way. And we can help!

iPiD enables payments anywhere in the world based on an ‘alias’. Using a single API, iPiD delivers the beneficiary information needed in any payment application to create your clients’ payment instructions based on a phone number or other alias. Your customers will no longer need to know or remember information such as BIC codes, IBANs, account numbers or routing numbers. We make global payments and remittances as easy as sending a text message.

User experience as signal of future success.

The trend towards frictionless payments that began in the domestic space is moving to international payments, and from high value to low value payments. Here too, customers have growing expectations for an easy and intuitive cross-border payments experience and will no longer stick with providers whose services demand them to complete complicated or difficult processes. These customers will ultimately gravitate towards providers who offer a more pleasing experience.

Now is the time for payment service providers to use the toolbox that exists to improve their customers’ journey without disrupting existing payment rails.

Find out more about iPiD!