Corporates

The Innovative Payment Validation Solution for Corporates

Leverage our single API to improve your payment experiences, mitigates fraud, and ensures every transaction is efficient. Our unique payee validation system is built to work with your existing payment rails, offering increased security and convenience in international payments.

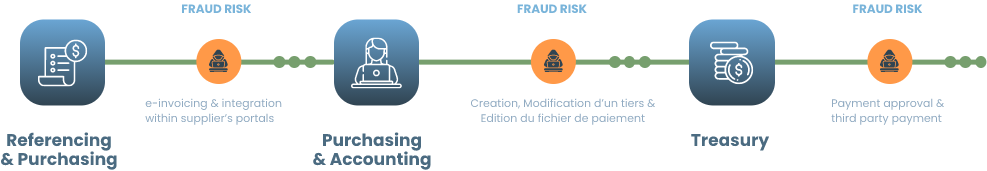

Supporting Corporate In Eliminating Fraud Risk

Corporates face a fraud risk at every stage of the Procure-to-Pay (P2P) process. Ensuring the validation of banking details from third parties, customers, and suppliers is crucial in eliminating manual errors and confirming the identity of each party involved.

Example of fraud risk at every stage of the Purchase-to-Pay (P2P) process.

Why Work with iPiD

Our technology provides clients with the simplicity of a single API, all while ensuring the highest level of compliance with data security and localization requirements. By integrating with your existing systems, iPiD enhances your operations without the need for a significant overhaul.

At iPiD, we take data security seriously. Our no-data storage policy means we do not store any data. You can be assured of complete confidentiality and privacy when using our solutions.

We use a decentralized model where no data is visible or transformed in iPiD\'s central routing engine. This enhances security and promotes trust, proving our commitment to protecting the integrity of every transaction.

iPiD is independent from the payment rails used to execute transactions. You can consume our APIs as pre-transaction data services, while keeping full autonomy and flexibility in the way that you move funds across the globe.