In this blog we ask what is an alias? What does an alias mean in banking and why use an alias for payments? We explain how the use of aliases – or proxies – enables a much better customer experience by making international payments as easy as sending a text message, and how they help banks and Payment fintechs to remove friction, errors and costs from the payments process.

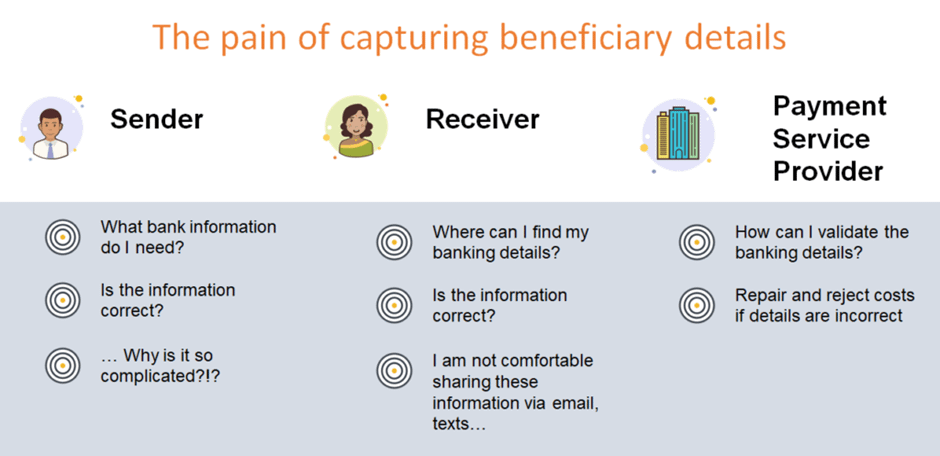

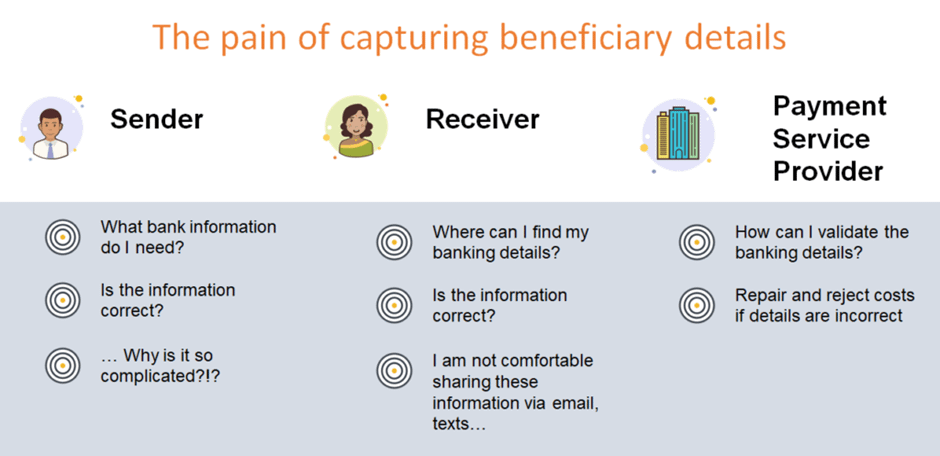

When someone wants to send a payment across borders, the capture of a beneficiary’s account and other details is perhaps the most difficult step from a customer experience perspective. It can be daunting to figure out the right BIC code, branch name, IBAN, BSB code, IFC code, etc.

Moreover, the pain is not limited to the sender.

The recipient must know all these relevant banking details, be certain that they are correct, and then share this sensitive information via the channel of their choice (such as by email or text).

Payment service providers face the challenge of handling any exceptions and investigations if something goes wrong – such as one small piece of information has been provided or input incorrectly. Unfortunately, things do go wrong quite often; and at a significant cost to the industry.

Failed payments cost the industry US $118.5 billion in 2020

Accuity, 2021